Introducing Xena

Patent professionals are not infrequently asked to analyze a portfolio of patents and provide an estimate of its quality and valuation. Since there are no standards for patent quality and valuations are idiosyncratic to the details of the needs of particular buyers and sellers, determining patent quality and valuation is more art than science. The most reliable way to determine patent quality and valuation is to ask a patent professional to analyze the scope of the claims of the patent in view of potential future uses of those claims.

Nonetheless there are methods for estimating patent quality and valuation that are both more reproducible and scalable than per claim analysis by a patent professional. The Xena Patent Analytics tool represents one such minimalistic approach.

A key assumption behind Xena is that most patent professionals have a benchmark portfolio of patents with which they are familiar as a result of their past activity. In some cases, this benchmark portfolio may even include patents that have been sold. In any case, it is possible — using the benchmark portfolio and some basic data for each patent within it — to calculate numerical scores of patent quality. While the set of possible numerical scores that could be calculated is infinite, for comparison purposes I have found it useful to limit the numerical score calculation to a weighted sum of normalized scores for time-adjusted forward citation count, scope of independent claims, and remaining time to expiration.

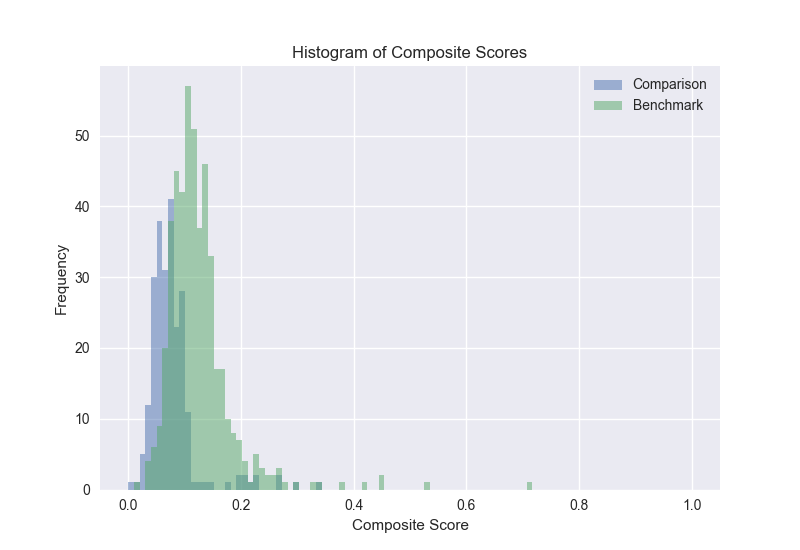

With a per patent numerical score calculated for a benchmark portfolio, the same portfolio can be sorted into percentiles. Now, taking an arbitrary portfolio of unfamiliar patents for comparison, the same numerical scores for the comparison portfolio can be calculated, and their relative percentiles (relative to the benchmark portfolio) interpolated. The relative quality of the patents in the two portfolios (benchmark and comparison) can thereby be plotted on the same histogram:

This by itself is a useful tool. It can be difficult to get a rough idea of the relative quality of two patent portfolios, each of which in general may include hundreds or thousands of patents. But rough estimates of price are also possible using a coefficient calculated from prior (ideally recent) sales of (ideally similar) patents. The coefficient may be set equal to the total of the numerical score of prior patents sold divided by the total price for which the patents were sold. Now a rough estimate of the price of patents in a portfolio can be determined using prices paid in the past.

All of this can be achieved in less than 200 lines of Python. I'm pleased to announce the publication of Xena as open source under an MIT license as of today. No April fools.

Click through to GitHub to download and try for yourself: https://github.com/riemannzeta/xena